- #Manual payroll in quickbooks for mac how to#

- #Manual payroll in quickbooks for mac manual#

- #Manual payroll in quickbooks for mac download#

If you wish to turn this feature off, we recommend manually updating QuickBooks once a month.

#Manual payroll in quickbooks for mac how to#

Learn how to update to the latest release of QuickBooks Desktop.

Update QuickBooks Desktop to the latest release. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. QuickBooks Support Get started Browse by topic. Learn more about the advanced features in QuickBooks Desktop Enterprise.

#Manual payroll in quickbooks for mac download#

Still, if you do not find an answer for your specific question within the community you can also post your question in the community to get the requisite answer from the contributing members.Ensure Critical Fixes is selected before you download the updates. If you ever feel the need of taking advice from your fellow business owners that happened to be our existing subscribers, you can visit our thriving QuickBooks Community.

#Manual payroll in quickbooks for mac manual#

If you are experiencing any issues related with enabling QuickBooks Manual Payroll, Dial QuickBooks Payroll Technical Support Numberand speak to Certified QuickBooks ProAdvisor Support Team. So, one can learn to use QuickBooks without any worry.

QuickBooks provides multiple features for performing different tasks that are very user-friendly. These are the basic points to remember while working on QuickBooks. To deposit payroll taxes with the deposit institution, one must use the Liability Check window to fill out a QuickBooks check. But you can make an unscheduled tax payment, if, for example, an active QuickBooks Payroll subscription is not available, a payroll tax present that isn’t set up as a scheduled payment, or an adjustment to a payroll tax has to be made. QuickBooks recommends the user to set up scheduled tax payments for payroll taxes. All you need to do set up the payroll schedule one time, assign the payroll schedule to the consulting employees, and then QuickBooks calculates the due dates for each upcoming pay period. QuickBooks calculates your upcoming payroll schedule so that you can pay your employees without any delay. It is upon you how often you pay your employees, on which date their paycheck is due, and which day you run payroll. You can set up payroll schedules to group employees with the same pay frequency be it daily, semi-monthly, bi-weekly, or monthly. QuickBooks tracks your payroll liabilities in the Payroll Liabilities account and the payroll expenses in the Payroll Expenses account.Īlso Read: Creating Customized Reports in QuickBooks Desktop Setting Payroll Schedules: For common payroll items, like compensation and benefits, QuickBooks provides extra assistance so that you can set them up. QuickBooks adds some items to the list for you, and you can add others according to your needs. To compensate, there are payroll items, taxes, other additions and deductions, and employer-paid expenses. It also has every expense of the company related to payroll, called the Payroll Item list. QuickBooks maintains a list of factors affecting the total amount on a payroll check.

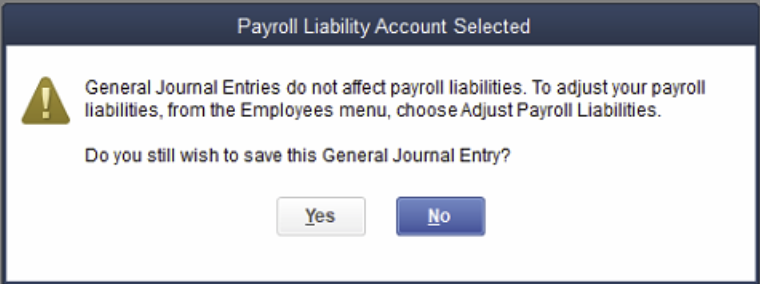

The process to enable and use Manual Payroll in QuickBooksīy default, QuickBooks enables the payroll feature but if you want to turn off this feature then you can do it manually by following a simple procedure:įirst, choose Preferences from the Edit menu and click on Payroll & Employees on the left panel. In this blog, we will discuss the process to enable QB Manual Payroll and the tax tables used in Quickbooks to calculate the Payroll. you can track the amounts through Quickbooks Manual Payroll. QuickBooks Manual Payroll is maintained by many small businesses whether it is for one people or more than one.

0 kommentar(er)

0 kommentar(er)